By Doug Kennedy

News Channel Nebraska

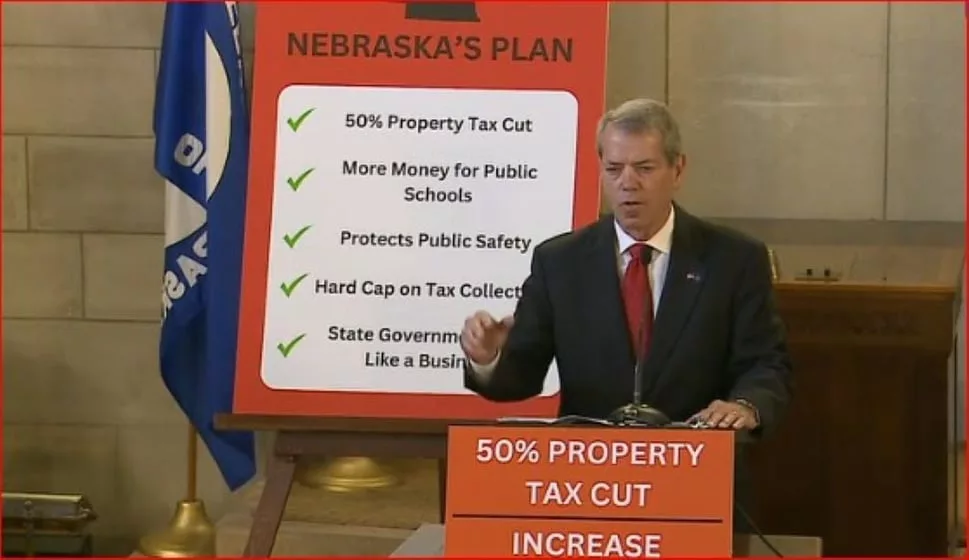

LINCOLN – Nebraska lawmakers will return to Lincoln for a special session, set to start July 25th. Governor Jim Pillen contends the health of the state’s economy is at stake, as he pushes for cutting property taxes by 50-percent.

“In the first 365 days I’ve been your governor, our property taxes went up $300 million. Folks have said, why the session now, why? Because it’s a crisis. If we don’t fix it, our property taxes will soon be going up a million dollars a day.”

Pillen has held several townhall-style meetings across Nebraska to drum up support for the plan. “We have tremendous, tremendous opportunities…and in this special session, I have great confidence in all of our partners in the unicameral, that we will solve the crisis. We will have a solution that will quit quitting on kids. We’ll have a solution where we will stop spending money…because spending has been a problem and giving up tons of exemptions in the last sixty years has been a problem….and they have to be addressed, and they have to be addressed now.”

Pillen said he wants a plan that is fair to all and provides significant and lasting tax cuts. Chair of the Legislature’s Revenue Committee, Senator Lou Ann Linehan said neglecting the problem risks keeping people from coming to Nebraska. She said in addition to the property tax reduction, the plan would have the state take a larger role in fulfilling its constitutional requirement of funding education.

“Local control will be maintained. They will still have school board members who can focus on students and teachers needs and learning outcomes…..instead of being in the rotunda each year while we are in session, begging for money.”

Linehan said the plan relies heavily on a cut in state spending and using that to bring property tax relief to citizens. “We must also generate new revenue, to further right-size our three-legged stool. This will only happen by placing sales tax on currently exempted products. The plan removes over a hundred and ten current exemptions. This may increase the final price for consumers, but they have choices on what they buy and how much they pay for what they buy….and ultimately, what taxes they pay. Today, when you get your property tax statement in the mail, you have no choice but to pay it, in full…on the day it’s due….or you lose your home, or your farm, or your business.”

Governor Pillen said the plan has ben formulated through the input of people across the state. A proposal that included a hike in the state sales tax did not advance during the regular legislative session. Under the plan to be considered in the special session, there would not be sales tax on food and medicine.