Paul Hammel

Nebraska Examinder

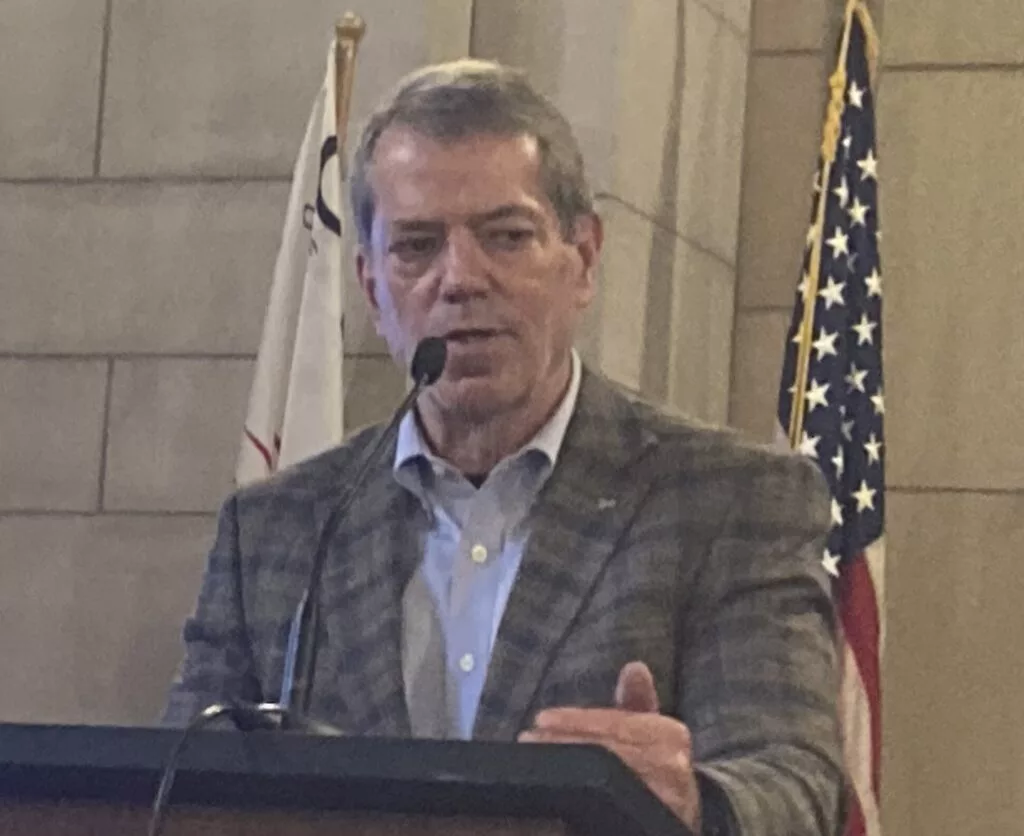

LINCOLN — Gov. Jim Pillen laid out an ambitious goal Monday of reducing local property taxes by 40% while providing few details on how the state would do that.

One week after floating a much-panned idea of raising state sales taxes, the first-term Republican called a press conference to discuss the “growth and impacts of skyrocketing property taxes” in Nebraska. He said he’s seeking a $2 billion reduction or shift in taxes away from much-despised property taxes via some combination of a tougher lids on local spending and broadening the sales tax base.

But when reporters asked Pillen over and over for details about which sales tax exemptions should be repealed and whether he supports raising sales taxes, he demurred, saying he planned to work with the 49 senators in the State Legislature to come up with a proposal that reduces local property taxes from $5 billion in total to $3 billion.

“From my seat, everything’s on the table,” he said.

“I’m committed,” Pillen added. “I’m all in. We’re not going to stop until we get to 40%.”

Americans for Prosperity opposed tax hike

The session came a week after he had floated a 2-cent increase in state sales taxes — which would make Nebraska’s sales tax the highest in the nation. The response was a thud, including from a reliably conservative group, Americans for Prosperity.

Pillen touted a “hard cap” on spending increases by K-12 schools, counties and cities, while making it clear that a sales tax exemption on groceries would remain in place.

Pillen also proposed a $2-a-pack increase in cigarette taxes, according to the Omaha World-Herald.

But when asked Monday if he was still on board with those ideas or was backing off, he deflected the questions, saying that it will take “trust” and positive thinking to address high property taxes.

“I hope we all favor fixing the problem,” Pillen said.

Not ‘married’ to sales tax hike

Immediate reaction to his comments Monday were mixed.

State Sen. Lou Ann Linehan, who heads the legislative committee that crafts tax policy, said the state is already about halfway there to Pillen’s $2 billion goal if you count the existing state property tax credits and the expected new tax revenue from casino gambling.

Linehan said she doesn’t think the governor was “married” to the idea of raising sales taxes. The senator said she expects state lawmakers to introduce several tax-cutting proposals from which the best ideas would be picked to devise a plan.

“I think we have people all over the board (now),” she said.

The head of the OpenSky Policy Institute, which often differs with the governor on tax policy, said that she awaits the specifics of Pillen’s plan but that shifting the tax load onto sales taxes makes it more regressive, because poor and rich Nebraskans pay the same rate.

“Property taxes are just one part of the overall tax burden and potential shifts to more regressive taxes to make up the difference adds strain on hardworking Nebraskans and their families,” said Rebecca Firestone in prepared comments.

Don’t threaten local services, says OpenSky

“OpenSky supports proposals to target property tax reductions to income-constrained Nebraskans without threatening the revenue available to fund local services,” she added.

But Mark McHargue, president of the Nebraska Farm Bureau, the state’s largest agriculture group, applauded Pillen, a pork producer, for undertaking the “difficult conversations” to achieve property tax relief.

“To his credit, the governor has not shied away from those conversations, and we thank him,” McHargue said, who added that Pillen appears to be headed “in the right direction.”

Pillen spent a portion of his press conference discussing how property valuations of farmland began spiking more than a decade ago. He also said a 40% reduction in property taxes would make Nebraska more competitive and would put the state in line with some other low-tax states, naming Texas, Arizona, Tennessee and Florida.

Last summer, the governor formed a working group of senators and representatives of business and agriculture groups to look at the recent double-digit increases in valuations of property for tax purposes. But that group quickly pivoted away from the valuation issue, concluding that the problem wasn’t valuations, but spending: Property taxes have risen $1.8 billion, or 56%, statewide over the past decade.

The working group did not endorse an idea floated by Pillen — to increase state sales taxes from 5.5 cents to 7.5 cents — an idea first reported by the Examiner.

One member of the group, Thurston Sen. Joni Albrecht, said the 2-cent hike was more or less a conversation starter.

North Platte Sen. Mike Jacobson, in an interview Monday, said he would be OK with a 1-cent increase in state sales taxes, rather than 2 cents as proposed by Pillen.

Sales tax exemptions, Jacobson said, could be removed on legal and accounting services, and a tax break on trade-in vehicles could be rescinded, which would bring in an additional $150 million for property tax relief.

That, he said, would be on top of the $1 billion-plus the state already provides in tax credits on property taxes and for homestead tax exemptions for the elderly and disabled.

Jacobson said he knows of a widow in his district who is being priced out of her home because of the steep hike in valuations and property taxes. That’s wrong, he said.

Pillen did not say Monday whether he supported or opposed plans introduced last week by Omaha Sen. Justin Wayne to transfer the cost and control of local jails to the state — thus taking the expense off the property tax rolls — and doing the same with county prosecutor offices. Wayne said the ideas would save more than $100 million in local property taxes.

Last year, lawmakers approved a similar move, removing the state’s community colleges from the property tax rolls and making it a state responsibility — via sales and income taxes — to fund those schools.