Paul Hammel

Nebraska Examiner

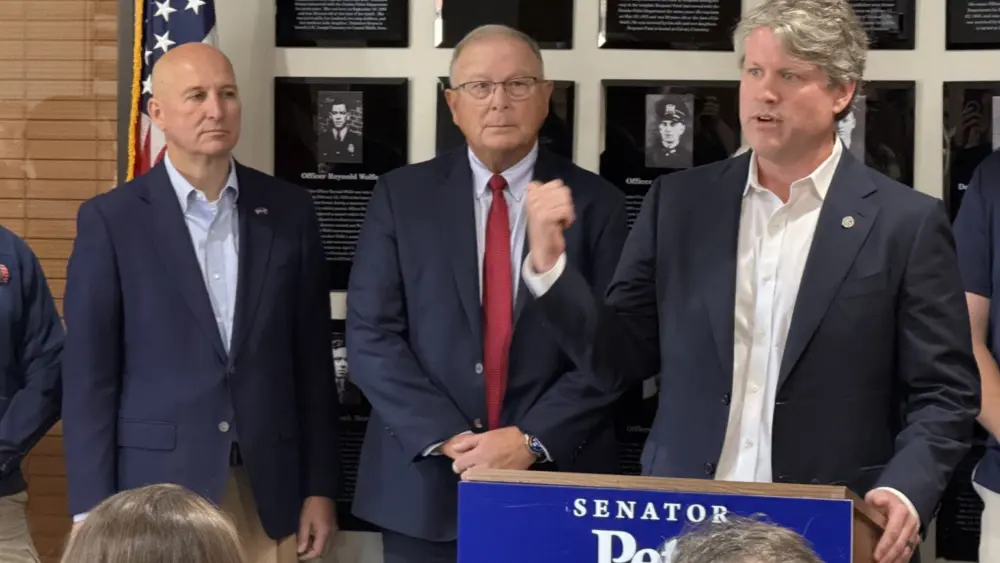

LINCOLN — Nebraskans aren’t claiming their refunds from a major tax break passed by the State Legislature, and Gov. Pete Ricketts joined other state leaders on Thursday to urge Cornhuskers to get after it.

About 40% of all Nebraskans this year failed to claim the property tax refund that must be claimed on a state income tax form, leaving about $200 million of tax refunds unclaimed.

‘A big deal’

It’s major money, Ricketts said.

For instance, the owner of a $250,000 home in Lincoln could have claimed $1,137 in refunds this year from the income tax credit and another state property tax relief effort.

“That’s a house payment,” Ricketts said at a press conference. “That’s a big deal.”

By next year, when 2022 income taxes must be filed, Nebraskans should realize a 30% reduction in their property tax bill, the governor said — if they take advantage of the income tax refund.

Two programs to reduce property tax

State lawmakers have launched two programs in recent years to reimburse Nebraskans for the state’s traditionally high property taxes, which are levied and paid locally: the Real Property Tax Credit, which shows up on someone’s yearly property tax statement as an automatic reduction. That long-running credit, the Department of Revenue announced Thursday, will amount to a $213 reduction in the 2022 property tax bill for the owner of a $200,000 home. The credit on $200,000 worth of farm or ranch land will amount to about $256.

Then there is the newer and bigger Nebraska Property Tax Incentive Act, passed in 2020. It provides a refundable income tax credit on property taxes paid to support K-12 schools and, beginning on next year’s taxes, on taxes paid for community colleges.

That newer tax break must be claimed on a state income tax form — which only about 60% of Nebraskans are doing. It began as a 6% refund on 2020 income tax bills, but will grow to 30% in tax year 2022 and is expected to grow larger until 2026.

Out-of-state taxpayers not aware

Ricketts, as well as State Sen. Lou Ann Linehan and State Tax Commissioner Tony Fulton, said that some Nebraska taxpayers aren’t aware of the need to file for the income tax refund because it’s still a new program.

“It takes time for it to sink in,” Fulton said.

Linehan added that people who live out of state and pay taxes here might not be aware of the tax credit.

When asked why the state doesn’t make the income tax break automatic, as it does with the older Real Property Tax Credit, Ricketts said it’s just not that easy — the state isn’t aware of what taxpayers pay in local property taxes, for one, to calculate the refund.

“This is the best way to do it,” the governor said.

State lawmakers opted for the income tax credit, rather than adding more money to the older and automatic Real Property Tax Credit, in part to make the state tax break more visible to taxpayers. The Real Property Tax Credit, it was reasoned, was just a line on an annual form, and taxpayers didn’t realize it was a tax break from the state on local property taxes.

Tax break for all

The income tax credit is also available to all Nebraskans, even those who don’t owe income taxes, while the Real Property Tax Credit is only given to those who own property.

Linehan, who chairs the Legislature’s Revenue Committee, which guides state tax policies, said she may have a fix in mind, involving including more information about the need to apply for the tax refund on mailings from the state.

To get the income tax refund, you can either file an amended income tax return for 2021, or claim the past refunds you may have earned on your income tax return next year. Fulton said refunds can be sought going back three years.

A “Nebraska Property Tax Lookup Tool” is available on the Department of Revenue’s website to help calculate the credit yo